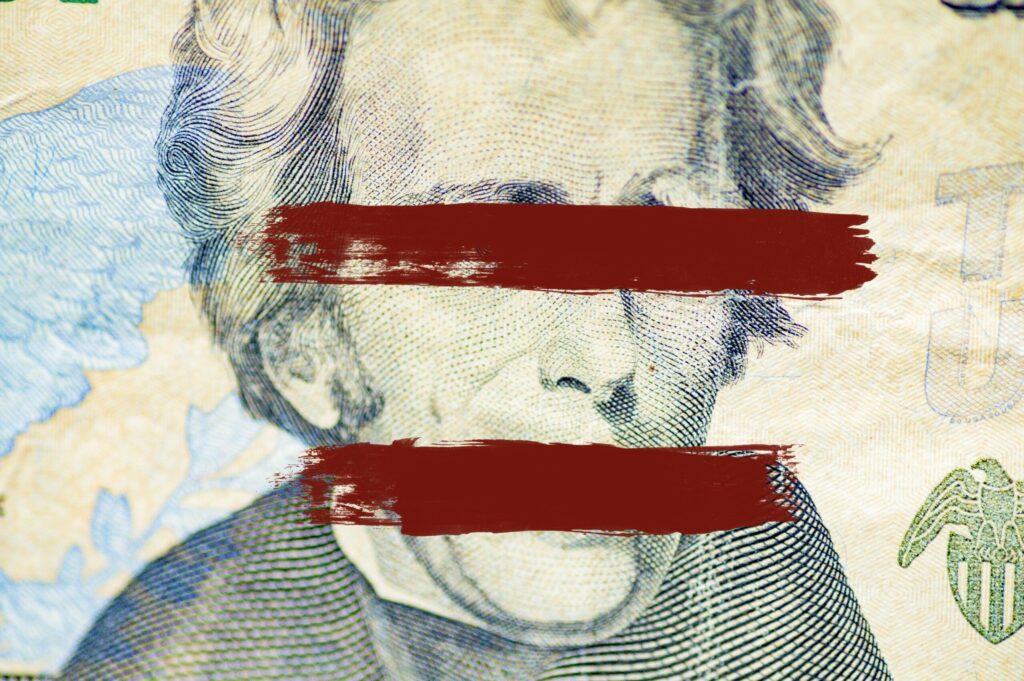

Tariff threat in US and Canada

What is the tariff threat the United States and Canada face?

In November 2024, President-elect Donald Trump announced he would impose tariffs on Canada, Mexico, and China. Trump announced on Truth Social that “as one of my many first Executive Orders, I will sign all necessary documents to charge Mexico and Canada a 25% Tariff on ALL products coming into the United States”.

There are multiple reasons cited for this policy: stopping the so-called “invasion” of drugs, particularly fentanyl, through the borders of Canada and Mexico, curbing illegal immigration coming from the two countries, generating more revenue for the US federal government and covering the estimated $710 billion budget deficit.

However, public analysts like Canadian economist Trevor Tombe predict that “if the U.S. follows through on this threat and Canada retaliates, both economies would take a significant hit…the economic cost for Canadians would be around CAD 1,900 per person annually. In the U.S., the impact would be nearly as large, about CAD 1,700 (around $1,184 USD) per person.” As long-time allies, Canada and the United States could easily have settled immigration or policing drug crime diplomatically and without putting the fragile economies of both countries at further peril.

And those are conservative estimates. It could be much worse based on several factors, such as a general economic slowdown. The same economist predicts that approximately 2.4 million Canadian jobs could be subject to U.S. tariffs, affecting the livelihoods of everyday people in a profoundly personal way.

What happened in the past when the United States imposed tariffs?

Unfortunately, this is hardly the first time the United States has used harmful tariffs to achieve policy goals. Previous attempts have not gone down well in history either. In 1930, the Smoot-Hawley Tariff Act imposed tariffs on tens of thousands of imported goods, ostensibly to protect farmers and other industries during the Great Depression. This tariff resulted in a trade war that led to world trade falling by 66% and U.S. exports and imports crashing by about two-thirds, worsening and prolonging the Great Depression and hurting global trade.

The story remains terrible in the more recent past. In 2018, Donald Trump imposed a 25% tariff on steel and a 10% tariff on aluminum imports, skyrocketing manufacturing costs for U.S. industries and reducing their market competitiveness sharply. That same year, a 25% tariff was imposed on washing machines to protect American industries, which increased the prices of washing machines and, by association, dryers significantly, with an additional $1.5 billion in expenses being borne by the American people. For two years, starting in 2018, the U.S. imposed tariffs on a large number of Chinese products, resulting in U.S. consumers paying much more for clothes, everyday household items, and many other essentials. The National Bureau of Economic Research found that U.S. consumers and manufacturers bore the brunt of these tariffs rather than the U.S.’s intended foreign target. More recently, tariffs on Canadian softwood lumber imposed on and off by the United States have led to higher housing costs in the United States, which continue to contribute to rising housing prices.

It would be more accurate to say that the reverse is true. The United States remains prosperous despite, not because of, tariffs.

Can tariffs bring in enough money for the US government?

In a tweet on January 03, 2025, Trump suggested, based on past US history, that tariffs could be the primary source of revenue for the American government and pay off its debt.

Regardless of tariffs’ historical importance (though that has not been positive either – see the previous question), it would be impossible to fund today’s United States primarily via tariffs from Canada and/or the world itself. Estimates by the Tax Foundation on the potential revenue from Trump’s proposal show how an ambitious 10 percent universal tariff would only raise $2.7 trillion over ten years, from 2025 to 2035, with a 20 percent universal tariff generating $4.5 trillion over the same time. Taxes on Canadian-American trade would fall far short of that since Americans only spent $481 billion on imports from Canada, according to the latest full figures from 2023. By contrast, income taxes bring in $2.2 trillion each year.

It is worth mentioning that even such estimates are optimistic because they assume the US economic pie will remain unchanged once the Trump Administration imposes new tariffs. Yet, as we have shown in our answers to previous questions in the FAQ, tariffs would leave consumers and businesses worse off. From a fiscal perspective, because tariffs are designed to reduce spending on imported goods, they lead to fewer actual imports, resulting in less revenue for the federal authorities.

Any notion of funding the federal government out of tariffs consequently remains wishful thinking, especially without committing to cutting spending.